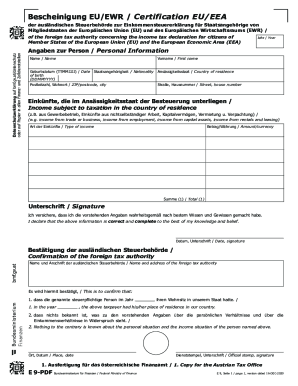

Get the free form e9

Show details

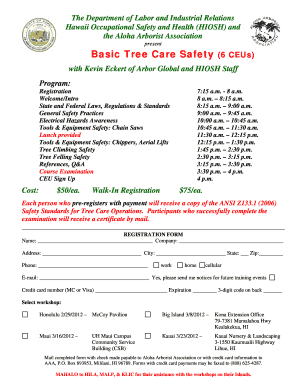

55200 Federal Register / Vol. 74, No. 206 / Tuesday, October 27, 2009 / Notices documents that are permitted to be filed via EFS-Web, information on how applications filed via EFS-Web are counted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign e9 form

Edit your e9 tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e 9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form e9 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form e9. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form e9

How to fill out e9 form:

01

Start by obtaining the e9 form from the appropriate authority or website.

02

Carefully read the instructions provided with the form to understand the required information and any specific guidelines.

03

Begin the form by filling in your personal details such as your name, address, and contact information.

04

Provide any necessary identification details, such as your social security number or passport number, as specified in the form.

05

If applicable, indicate your marital status and provide information about your spouse or dependents.

06

Provide detailed information about your employment history, including current and previous employers, job titles, dates of employment, and income details.

07

If required, include information about your education history, including degrees earned and institutions attended.

08

Fill in any additional sections or fields as directed, such as those related to tax credits, deductions, or exemptions.

09

Review the completed e9 form for accuracy and completeness before submitting it.

Who needs e9 form:

01

Individuals who are employed and have income from employment.

02

Anyone who needs to report their income, deductions, and credits to the tax authorities.

03

The e9 form is usually required by taxpayers for the purpose of filing their annual income tax returns.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

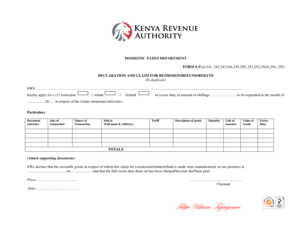

What is e9 form?

The term "e9 form" does not have a specific definition or context. It is possible that "e9 form" refers to a specific document, form, or process related to a particular organization, industry, or country. Without further information, it is difficult to provide a more specific answer.

Who is required to file e9 form?

The term "E9 form" does not refer to a specific form or document in any recognized context. Therefore, it is not possible to determine who would be required to file such a form without further information or clarification.

How to fill out e9 form?

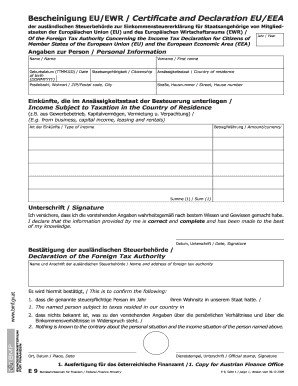

To properly fill out an E9 form, which is used for reporting employee withholding exemption information, follow these steps:

1. Begin by entering the employer's name, address, and employer identification number (EIN), also known as a federal employer identification number.

2. Provide the employee information, including their full name, address, social security number, and the total number of withholding exemptions claimed.

3. If the employee is exempt from federal income tax withholding, they must complete the appropriate section stating so and sign the form. This exemption applies if the employee had no tax liability last year and expects none this year or if they qualify for other exemptions listed on the form.

4. The employer should ensure that the employee has filled out all the necessary fields and has signed the form. Note that the form requires an employee's signature under penalty of perjury, confirming the provided information is accurate.

5. Retain a copy of the completed and signed E9 form for your records.

It is important to note that the information provided on the E9 form must be accurate, as it is used by employers to determine the appropriate amount of federal income tax to withhold from an employee's wages.

What is the purpose of e9 form?

The purpose of the E9 form, also known as the Certificate of Vendor Compliance, is to certify that a vendor or supplier has properly registered and is in compliance with the requirements of a particular organization or government entity. This form helps ensure that vendors adhere to specific rules, regulations, and standards set by the organization or government agency, such as tax compliance, necessary licenses or permits, and other legal requirements. It is typically used as a documentation and verification tool during procurement processes.

What information must be reported on e9 form?

The E9 form, also known as the Certificate of Tax Withheld at Source, is a form used in the Philippines to report and remit withholding taxes. The following information must be reported on the E9 form:

1. Taxpayer Identification Number (TIN) of the withholding agent

2. Name and address of the withholding agent

3. The month and year for which the withholding tax is being reported

4. Gross compensation paid to employees or payees

5. Amount of tax withheld from the gross compensation

6. Compensation subject to withholding tax

7. Tax rate applied for each type of compensation (i.e., 5%, 10%, 15%, etc.)

8. Taxable and non-taxable allowances, benefits, or fringe benefits

9. Other taxable income subject to withholding tax

10. Total tax withheld

Additionally, the E9 form may require other information specific to certain types of income, such as dividends, interest, royalties, prizes, or winnings.

How do I complete form e9 online?

pdfFiller has made it easy to fill out and sign form e9. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the form e9 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form e9 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit form e9 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing form e9, you need to install and log in to the app.

Fill out your form e9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form e9 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.